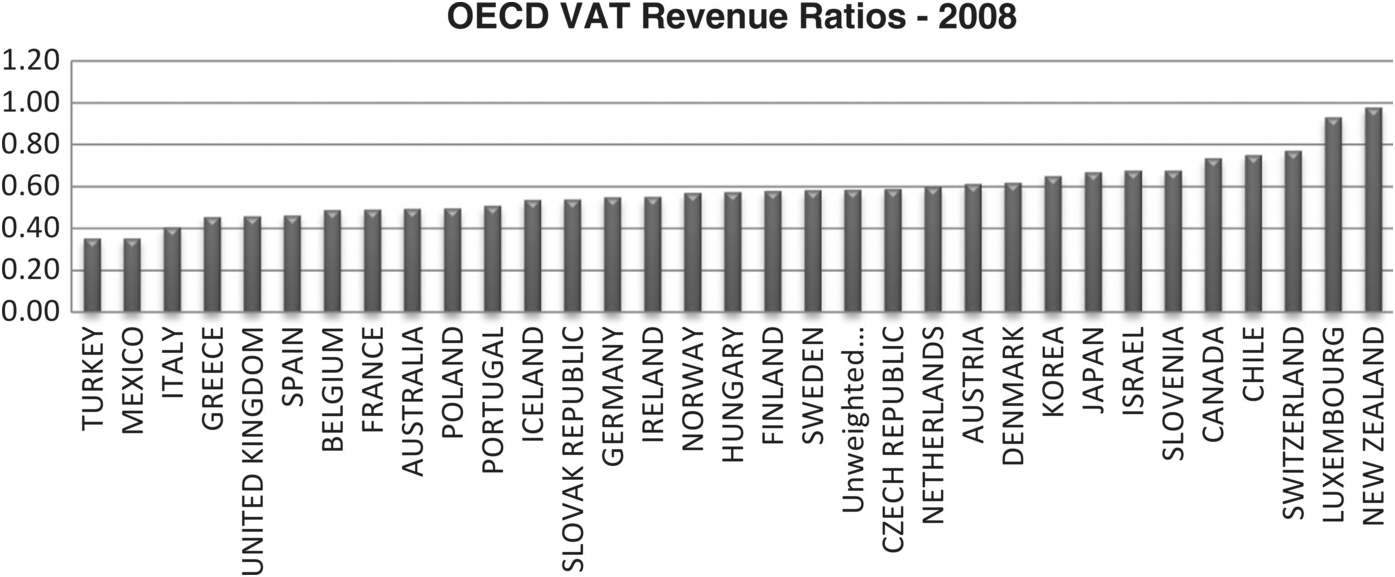

PDF) The issue of VAT gap in Poland in contrast to the European Union member states as a threat to financial security of the state

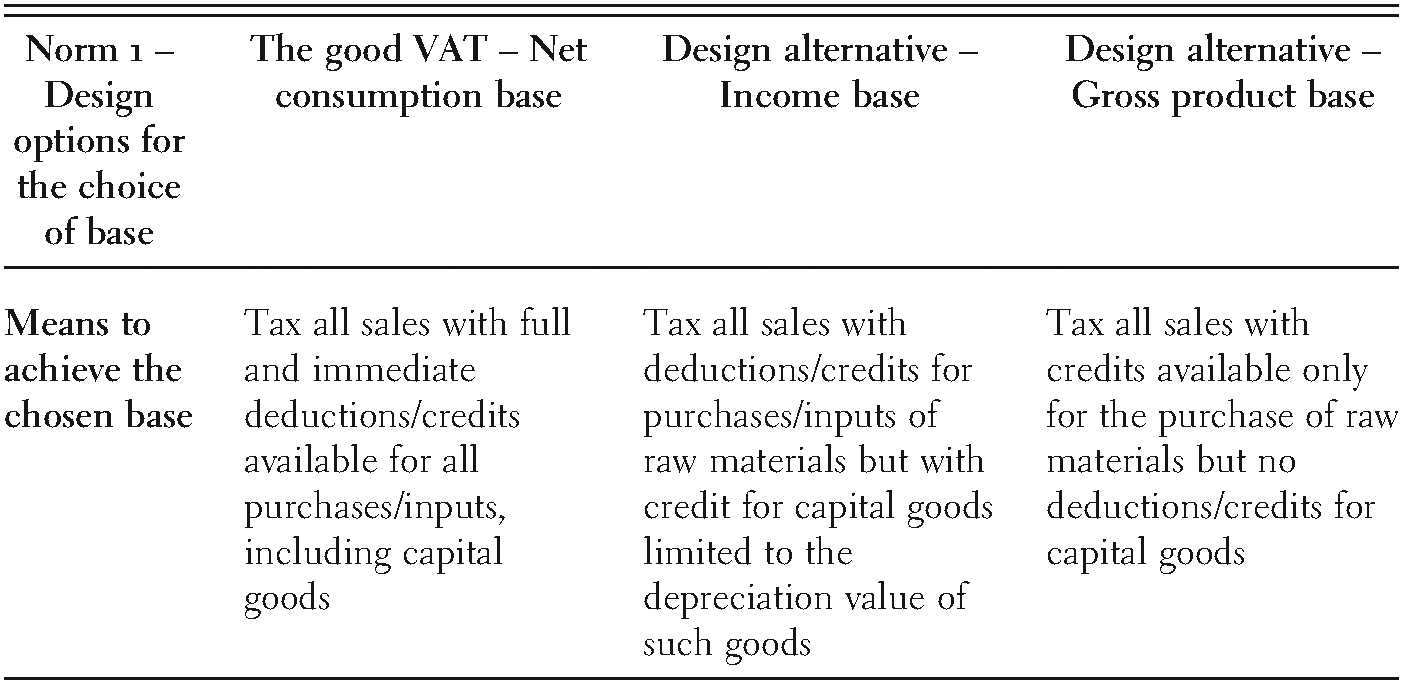

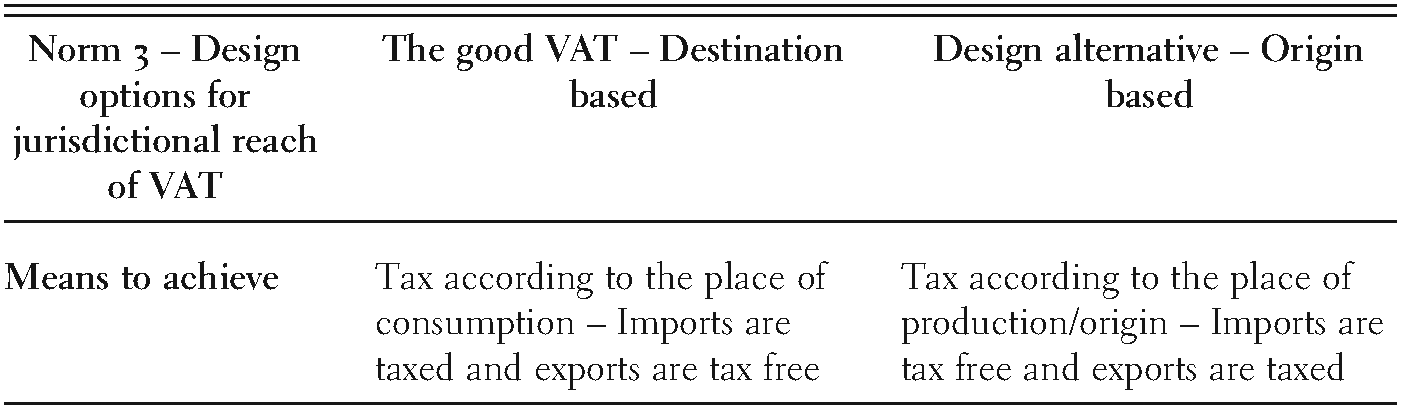

The rise of the value-added tax – Exploring the gap between expectation and delivery (Part I) - The Rise of the Value-Added Tax

The rise of the value-added tax – Exploring the gap between expectation and delivery (Part I) - The Rise of the Value-Added Tax

PDF) The issue of VAT gap in Poland in contrast to the European Union member states as a threat to financial security of the state

The rise of the value-added tax – Exploring the gap between expectation and delivery (Part I) - The Rise of the Value-Added Tax

The rise of the value-added tax – Exploring the gap between expectation and delivery (Part I) - The Rise of the Value-Added Tax

PDF) The issue of VAT gap in Poland in contrast to the European Union member states as a threat to financial security of the state