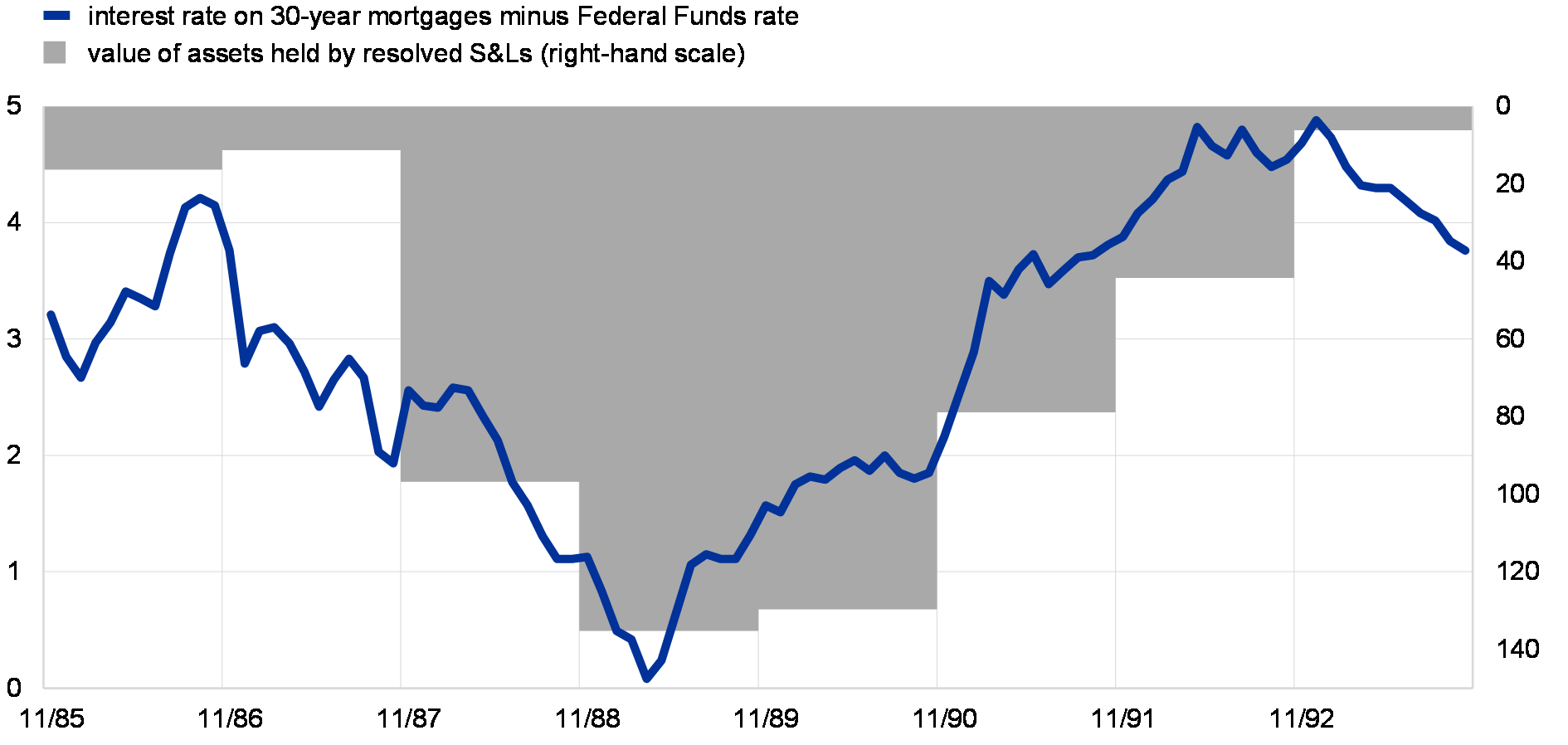

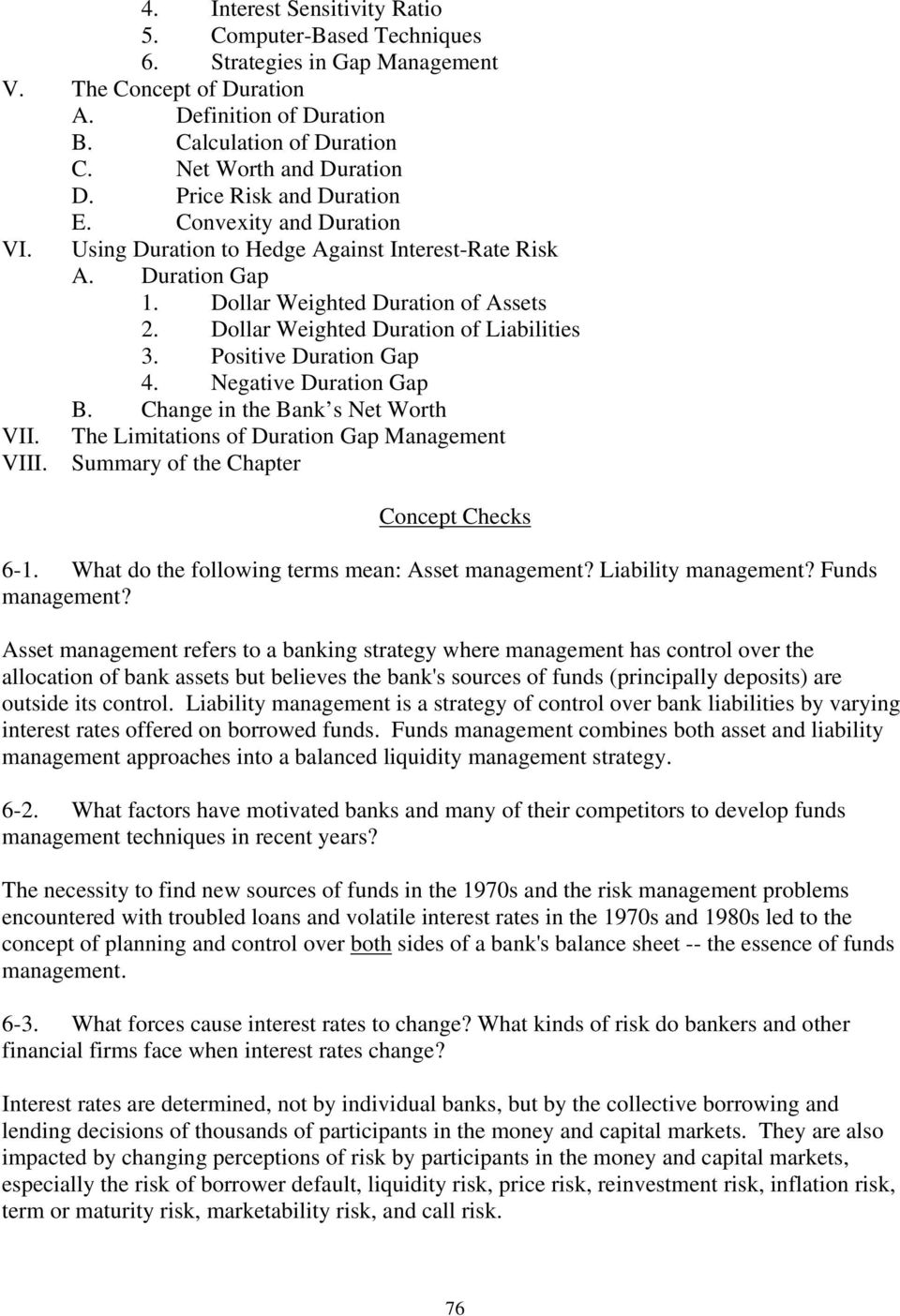

CHAPTER 6 ASSET-LIABILITY MANAGEMENT: DETERMINING AND MEASURING INTEREST RATES AND CONTROLLING INTEREST-SENSITIVE AND DURATION GAPS - PDF Free Download

CHAPTER 6 ASSET-LIABILITY MANAGEMENT: DETERMINING AND MEASURING INTEREST RATES AND CONTROLLING INTEREST-SENSITIVE AND DURATION GAPS - PDF Free Download

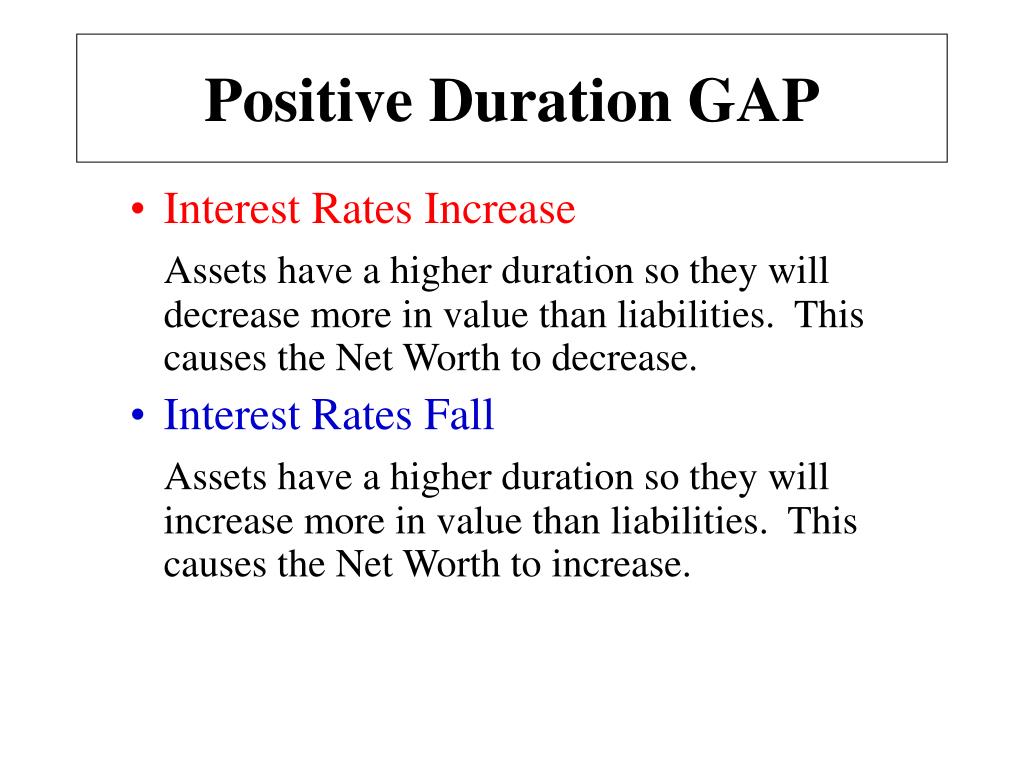

Techniques of asset/liability management: Futures, options, and swaps Outline –Financial futures –Options –Interest rate swaps. - ppt download